Headcount Changes, Variation In Pay Trends Suggest Inflation Risk Is Intensifying

Should business leaders worry about a wage-price spiral as headcounts and pay trends change? As the economy fluctuates, planning for multiple futures is a must.

Walmart’s announcement that it will raise its minimum wage by 17% is good news for workers who have been struggling to keep up with a higher cost of living. The U.S. inflation rate—which has fallen in recent months but remains elevated after peaking at 9% in 2022—is making it harder for many people to afford food, household items, and other necessities.

On top of helping workers manage higher costs, the move will also help Walmart stay competitive in a tight retail labor market. Meeting headcount demands remains a challenge within the service sector.

However, if inflation picks up again, rising prices combined or higher interest rates could eat into purchasing power gains achieved through pay raises. If other employers follow suit with similar wage hikes, the retail giant could face pressure to introduce another wage bump.

In the worst case scenario, the U.S. will experience inflationary déjà vu. During the 1970s, inflation soared, eventually reaching a peak of 14.76% in April 1980. Spiraling costs were only tamed after the Federal Reserve Board (the Fed) introduced a staggering interest rate that exceeded 19% to reign in demand, which led to not one—but two—recessions.

The current situation is not likely to become a case of history repeating itself, but as is demonstrated by the latest interest rate increase, the Fed hasn’t won its battle with inflation yet. And as Former Goldman Sachs chief operating officer Gary Cohn has said, more than anything else, the Fed is watching jobs data the closest.

How worried should employers be about a wage-price spiral?

Betsey Stevenson is the Professor of Public Policy and Economics at the University of Michigan and former Chief Economist of the U.S. Department of Labor. Speaking as a guest during Visier’s Human Truth Podcast, she explained that a wage-price spiral happens when employers keep competing for the same too-small pool of workers.

In this situation, wages go up and employers offset the cost by raising prices. This then triggers demand for higher wages—creating a feedback loop between higher inflation and wage increases.

Whether this has already started happening is the subject of debate.

“Now, right now it does not look like our inflation was caused by any kind of wage price spiral. Instead inflation was caused by supply chain problems that had to do with durable goods and the fact that demand for everything recovered faster than supply chains could recover," Stevenson said during the podcast, which aired in December 2022.

Stevenson’s analysis was echoed by Lael Brainard, the Fed’s Vice Chair, in January. Brainard said that several indicators provide some reassurance “that we are not currently experiencing a 1970s-style wage–price spiral.”

But Brainard’s statements run counter to what many of her colleagues have suggested, which is that rising wages for employees in service worker positions are driving prices up. A Gallagher survey of 800 U.S. companies, conducted in 2022, revealed that nearly two-thirds of employers were increasing compensation budgets due to inflation.

Even if a wage-price spiral has not already started, there is still a risk that one could impact inflation in the future. As Stevenson stated, “the fear is that if the labor market’s too tight, then what started as supply chain issues could easily take off and become a wage price spiral, particularly with workers looking to change jobs because of inflation.”

A red-hot labor market’s effects

That’s why recent numbers probably had many policy experts exhaling and then holding their breath again. According to Bureau of Labor Statistics data, the U.S. added 223,000 jobs in December 2022, a slight deceleration from the rapid job growth that took place earlier on in the year. Then, in a surprise development, the U.S. added 517,000 jobs in January 2023—far exceeding what economists had predicted.

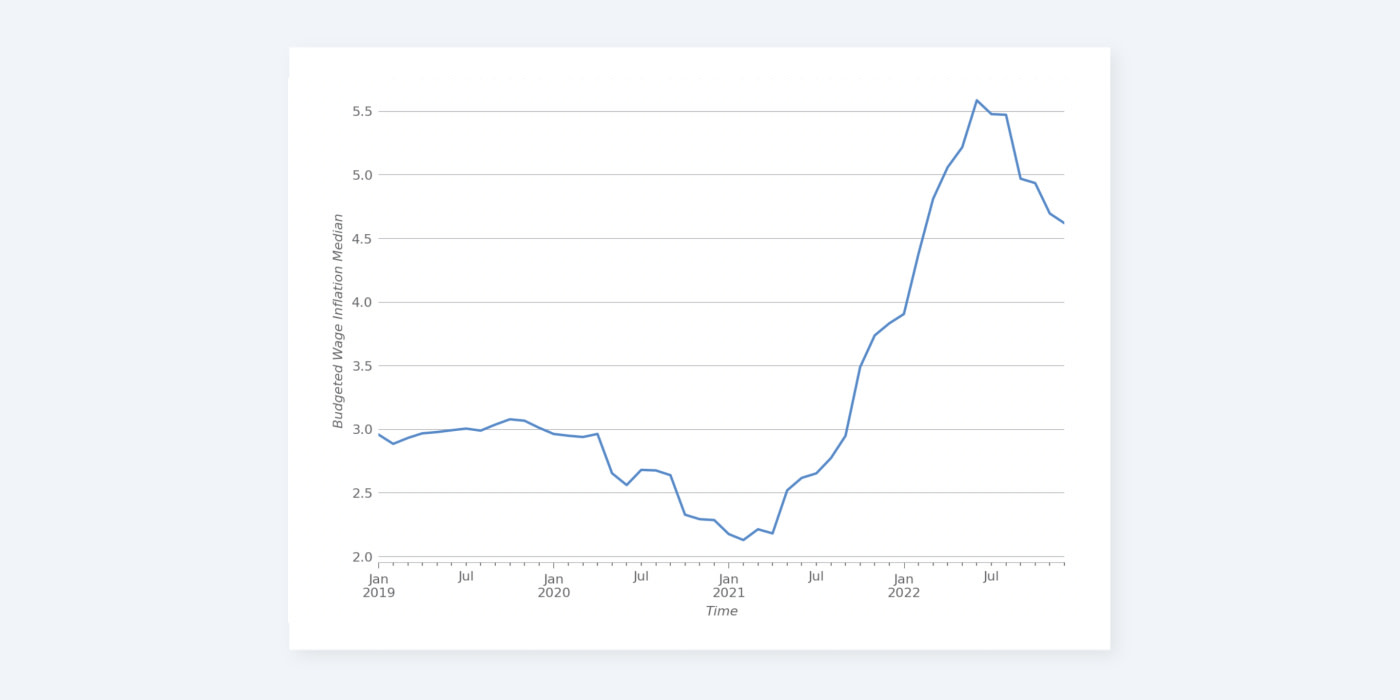

The rate of wage increases, however, stayed more in line with a general cooling trend. In January, the annual wage increase was 4.4%, down from 4.8% in December. Wages rose by more than 5.5% between June 2021 and June 2022 (annual pay raises typically hover around 3%).

Figure 1: Budgeted wage inflation median trends

But January’s unexpected job gains indicate that the labor market might not be loosening enough to alleviate inflation risk. (The new numbers also serve as a reminder that layoffs in the Tech sector only represent a small slice of the overall economy.)

In fact, the Visier data team stumbled across an intriguing correlation when examining the headcount change data from a subset of the Visier Community database. Data from 40 enterprise-sized organizations based in the U.S. reveals that the inflation rate was tracking headcount change by several weeks with a correlation of 0.95 in 2021 (see Figure 2).

Figure 2: Annual headcount change (blue) compared to the Inflation rate (Green), shown in weeks. The orange line represents the rolling 3-week average for headcount change.

While this doesn’t necessarily mean there is a definitive cause-and-effect relationship between headcount growth and inflation, it’s yet another element to consider when gauging inflation risk.

Conflicting signals: a major wage hike amidst smaller pay gains

While the job market is booming, January’s smaller wage gains suggest that inflation isn’t spiraling out of control. But Walmart’s recent wage boost bucks this overall trend—and it should not be completely dismissed. After all, it is the largest employer in the U.S.

If prices start taking off again, the Fed will take more aggressive measures to tame inflation through higher interest rates, constraining growth for interest-sensitive industries, such as the housing and automotive sectors. Indeed, the increased cost of borrowing generated by rate increases are partially to blame for the recent wave of Tech-sector layoffs.

The bottom line for business leaders? The economic outlook is cloudy, so plan for multiple futures, and book the more conservative plan in the interim until trends become clearer.

Keep tracking interest rates, and consider how tighter fiscal policies impact the organization’s growth prospects so that hiring and compensation budgets can be planned accordingly in an effort to avoid unnecessary layoffs down the road.

1970s-style inflation trends don’t appear to be making a full comeback. But employers should still be prepared. This way, they won’t get caught off guard by a wage-price spiral or full-blown recession.