A New Workforce Planning Model: Why Position Management Is Flawed

Learn how to better track workforce plans and ensure managers have the funding they need when a critical position opens up.

Creating a workforce plan based on position management works fine at the budgeting stage, but once you get into the fiscal year, you may be left with no budget for a new hire. How does this happen? In this article, discover how to better track workforce plans and ensure managers have the funding they need when a critical position opens up.

Given that people costs can account for up to 70% of an organization's operating expenses, getting the workforce plan right is fundamental to good corporate fiscal health. Yet most Finance departments still develop budgets for people the same way they do for chairs—an outdated approach that creates risk and headaches for the organization.

As a best practice, workforce planning should be continuous. However, the reality is that for most companies the workforce planning process is precipitated by the annual budget cycle, when Finance provides the cost or FTE limits for each department, passes the budget to HR, and then HR uses their workforce expertise to refine the plan. The problem is that Finance’s budget does not take into consideration important details about:

Role type

Team formation

Historic and seasonal turnover trends

Projected employee movement

Organizational changes that are key to delivering the business plan

As a result, the budget provided by Finance does not articulate the impact on teams and the roles that need to be planned for and managed throughout the workforce plan’s lifecycle.

The human layer of workforce cost management

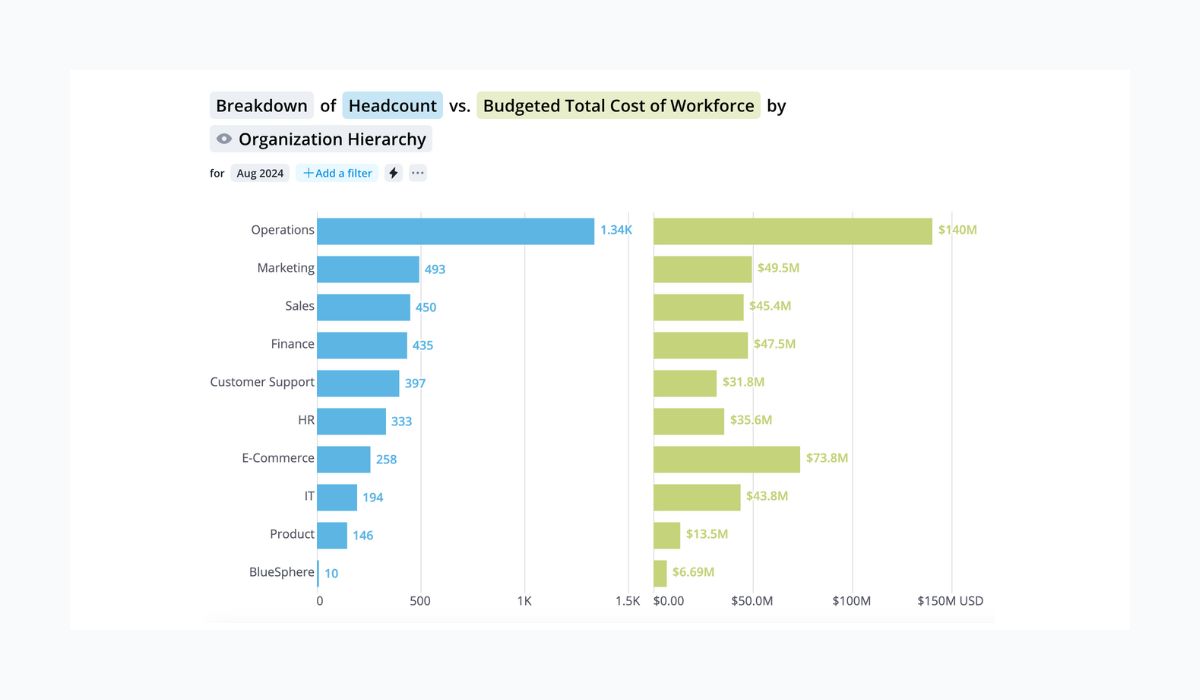

Finance is numbers-oriented. If a team has six full-time employees and plans to hire four more this year, Finance counts that as 10 positions. Salary values are assigned to the 10 positions, and that is the team’s total workforce budget.

From Finance’s perspective, there are “six filled chairs and four chairs to be filled for a total of ten chairs in Marketing Operations this year,” but the reality is that teams are rarely this stable. Employees may leave the company, get promoted to a different position or team, or go on leave at any point in the fiscal year.

Teams may need to fill more or less positions than they originally planned, but their ability to manage this type of churn is hindered by the basic way in which cost limits are allocated and the inflexibility of the plan monitoring process.

As a result, line managers and HR teams work within a budget that does not adjust to reflect their teams' realities, often resulting in shortcuts (like hiring contractors) and workarounds (like delaying hires) that increase costs and decrease productivity.

Tracking based on position management doesn’t work

Creating a workforce plan based on position management works fine at the budgeting stage, but once you get into the fiscal year, tracking positions is like playing a game of musical chairs. When the music cuts out, you may be left with no chairs—a.k.a. budget for a new hire. How does this happen?

Organizational structures change frequently due to circumstances such as employee turnover within an organization or changes in business priorities. To Finance, an empty position simply means no costs are incurred. Finance will often count this as a cost-saving and look to “manage” a vacancy rate to reduce spending. But to HR and team leaders, that empty seat could either mean revenue that is not being earned or customer satisfaction that is being reduced.

When positions are considered neutral “chairs,” balancing labor costs against productivity demands becomes extremely tough, leading to waste and missed goals. Managing between the two worlds of neutral cost buckets and the dynamics of people, teams, and business demands becomes extremely time-consuming, manual, and wasteful. If that empty seat eventually does need to be filled, the budget assigned to that “chair” may not get released or have been allocated elsewhere.

When HR tries to fit the people plan into the budget framework from Finance, they’re forced to forget about people dynamics, market demands, and changing business objectives throughout the year. Finance’s model is ideal for creating the budget, but not for tracking the budget and people movement.

One of our customers used to have upwards of 25 staff whose sole job was to keep track of how positions were changing and where employees were moving within the 30,000-person organization. It was a huge expense that could not guarantee accuracy or efficiency.

When workforce plans are tracked improperly, line managers end up having to fight for more budget in the middle of the year. If they don’t get the funding needed to make the hire, they may leave a critical position empty until next year, resulting in higher costs due to lost productivity and missed business targets. They may also resort to hiring contingent workers who bring all sorts of other costs and risks with them.

Finance will often count this as a cost saving and look to “manage” a vacancy rate to reduce spend. But to HR and a line of business leader that empty seat could either mean revenue that is not being earned or customer satisfaction that is being reduced.

This leads to situations such as that of a company with 20,000 employees — and 9,000 extra positions. The budgeting by position management led them to have 29,000 potentially funded positions in an organization with 20,000 actual people. If the average budgeted cost for each position is $50,000, then there is potentially $450 Million of approved cost that the company is struggling to track. In addition, a portion of this money is “locked” inside the budget and therefore, is not available for strategic business initiatives such as new product development.

Applying business analytics to workforce plan tracking

Being nimble is increasingly important to business leaders. Strategic workforce planning requires a more agile model, but this has been difficult to implement due to an over-reliance on spreadsheets, the huge number of stakeholders involved, and communication and time constraints.

Even as HR becomes more data-driven, they often still track workforce plans using the position-based spreadsheets generated by Finance POS. Traditional analytics—derived from limited transactional systems or expensive data warehouse projects—can’t drill down to the team level and pick up on the nuances of position changes. For example, if the workload is too much for one position, a manager may decide to split it between two new positions, essentially creating two chairs at two different costs.

The little information that can be extracted takes an army of people and weeks to accomplish. This expensive strategy makes the business too slow to react to shifting strategies and market changes.

We encountered one organization where the HR Business Partners spent one day a week reconciling budgets to actuals and tracking people's movements relative to costs. They understood how negative this approach was, as 20% of their time was non-value-adding.

So how can you better track workforce plans and ensure managers have the funding they need when a critical position opens up? Here is how to build a new workforce planning model:

Stop tracking workforce plans based on Finance’s budgeting model

Move to a continuous planning

Look for technology that makes the job faster and easier

1. Stop tracking workforce plans based on Finance’s budgeting model

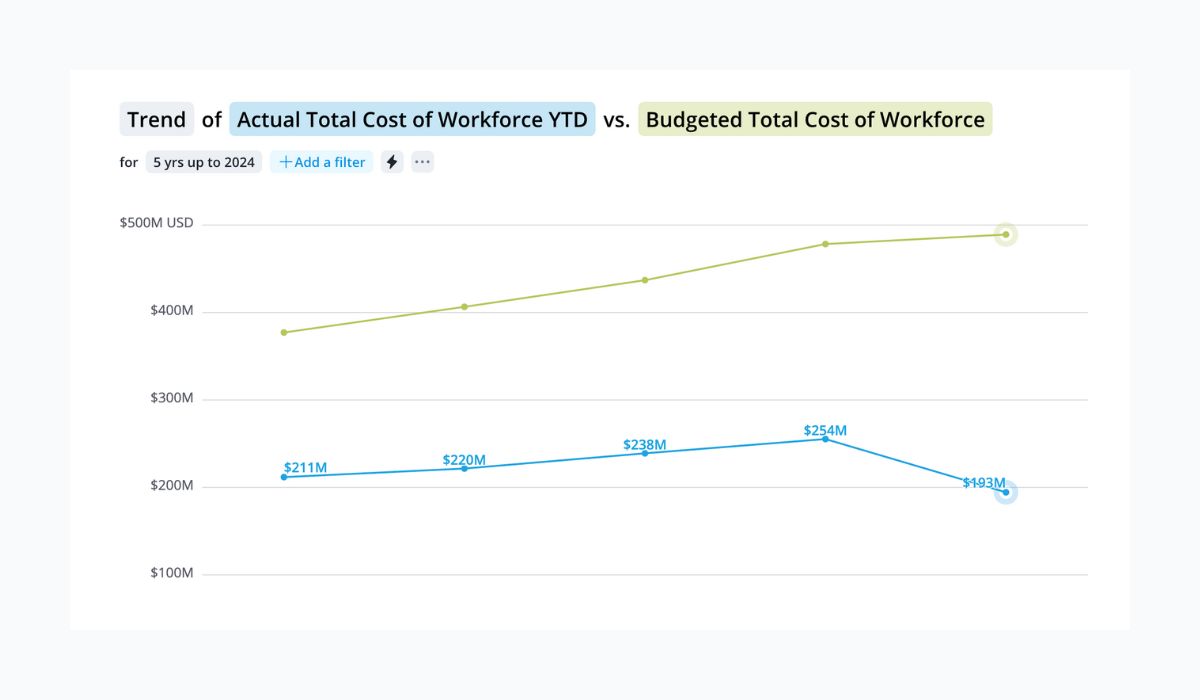

With workforce planning, you’re ultimately trying to answer whether you spent more or less than you should have on your people. When HR tries to reconcile the workforce plan by position, the plan collapses as soon as that position changes. Instead, in this new workforce planning model, HR should move to a plan-to-actuals comparison, which enables more precise tracking of team-level changes and makes budget tracking easier.

2. Move to a continuous planning model

When workforce planning is continued only during the annual budget planning stage, it leads to talent shortages, missed opportunities, and other risks. Reviewing the plan to actuals routinely throughout the year helps you see problems before they become pitfalls. With this kind of insight, you and the line managers can investigate both problems and successes and re-allocate budget according to what will happen in the future.

3. Look for technology that unifies HR data with Finance data

As I’ve mentioned, using analytics to model and compare future workforce scenarios has traditionally been an expensive, imprecise, and time-consuming process. However, a comprehensive people data platform connects data from all HR, Finance, and other business systems to provide a complete and accurate picture of your organization.

A powerful people data platform enables rapid cycle planning so you can look ahead at how many open positions need to be filled, when they must be filled by, and where in the organization they are needed the most. This gives you the necessary time to either move budget around or talk to the manager about delaying the hire until budget accumulates.

When workforce planners can access the current budget or forecast from Finance through an integrated people data platform, they can seed the upper limits on headcount and make data-driven decisions in advance of problems arising. Using historical data for projections while enabling quick collaboration between planners creates a more accurate hiring forecast. It's the best way to avoid the music cutting out too soon and finding yourself with a critical chair that needs filling and no way to fill it.

Read more about strategic workforce planning

What if we tried a new approach to work planning? Explore the benefits of a new approach to people planning in the new workplace.

Want to get started on the adoption of strategic workforce planning practices and move up the maturity curve? Here's how.

Agile workforce planning practices enable organizations to minimize risk and capitalize on upside opportunities. Learn more.